Our credit solutions enable clients to manage the ebb and flow of the art and antiques markets more effectively, thereby empowering clients with additional buying power and liquidity when it is most needed. Importantly, our products and services allow clients to rapidly convert illiquid assets into working capital without requiring the sale of the assets that secure our transactions. As a result, our clients retain the benefit of any appreciation in the value of their collection while still enjoying the flexibility that leverage provides.

We partner with each of our clients to find structured solutions to the diverse challenges that unconventional assets present. Our relationship driven approach is the keystone of our success and is the driving force behind this rapidly growing segment of our business.

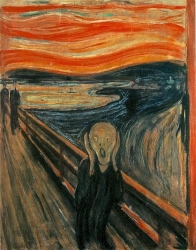

Some of the alternative assets we assist in financing include truly exotic investments, collectibles - classic cars, vintage wine, rare coins, fine art, antiques as well as rare historical relevant pieces of history for both the U.S. and abroad.

We offer competitive rates and terms, and use our experience to structure a plan that meets your requirements. Our programs include:

- Fixed and Rotary Wing Aircraft

- Full, Limited, & Non-Recourse Structures

- Term Loans

- Finance & Operating Leases

- Progress Payment Financing

- Qualified International Jurisdictions Worldwide

Our Superyacht Financing is available to eligible clients both domestically and internationally. With our competitive interest rates, flexible repayment terms and bespoke structures, we can assist you in the acquisition, financing or construction of luxury yachts. Term loans for new purchase, construction loans for European and US projects, refinancing and competitive lending levels are available.

Financing available for new or pre-owned motor and sailing vessels

- Minimum yacht size of 40 meters

- Minimum yacht loan size of $10 million

Through our efficient, end-to-end lending process we provide mortgage capital to owners of quality commercial property who maintain a strong business plan. With flexibility and speed of execution, we offer a broad range of financing capabilities, including:

- On-book/non-recourse bridge financing

- Senior and stretch senior solutions

- A typical transaction of $10 million or more

- 3-7 year loan terms

Whether it is commercial real estate, intellectual property, alternative assets, non-performing loans or others forms of a clear value based piece of collateral, our team works with clients to extract the risks and insulate them from a potential downside exposure.

The current dynamics in the capital markets and the economic downturn have combined to create extraordinarily challenging conditions for lenders and investors. Lenders and investors require partners and service providers with the experience, capabilities, platform, and knowledge to successfully navigate an extraordinarily complex array of issues. Balance sheets, capital ratios, operating reserves, and long-standing relationships are strained from the difficulties of determining current asset values, regulatory scrutiny and mandates, replacing existing financing, enhancing collateral, generating liquidity, maintaining the physical integrity of assets, selling assets, and capturing market share in today's market.

Our turn around team can help clients recalibrate former exit strategies and product as much sustainable value within each asset.